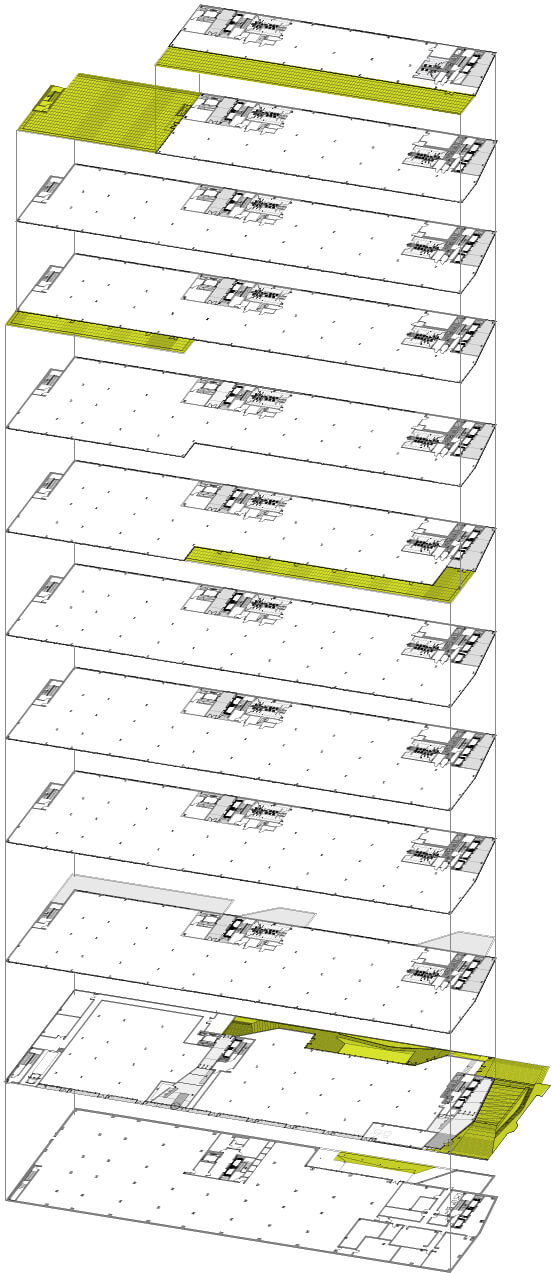

Floor 11

14,730 RSF (Terrace 3,619 SF)

Floor 10

19,705 RSF (Terrace 3,415 SF)

Floor 9

28,883 RSF

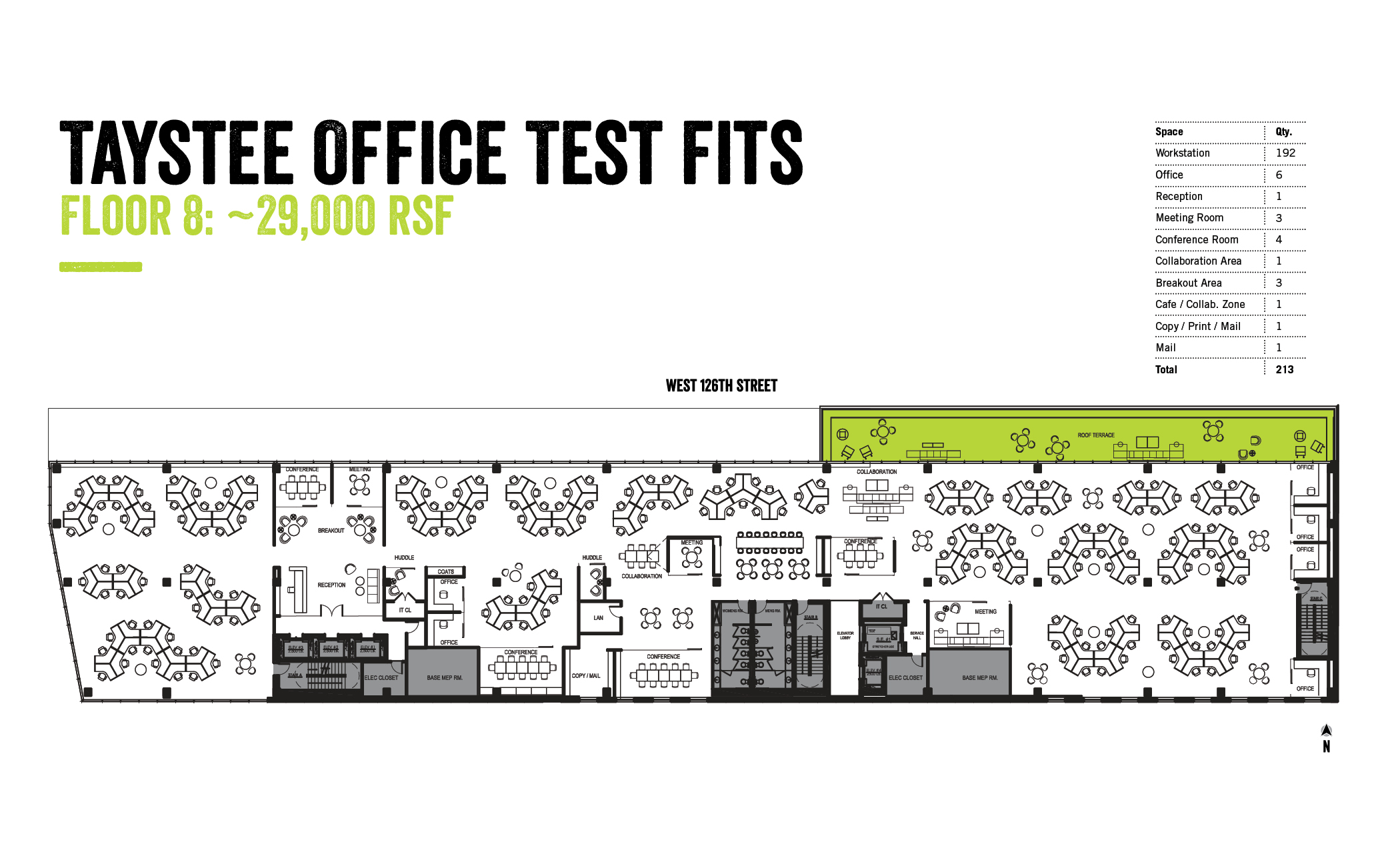

Floor 8

28,883 RSF (Terrace 2,121 SF)

Floor 7

31,870 RSF

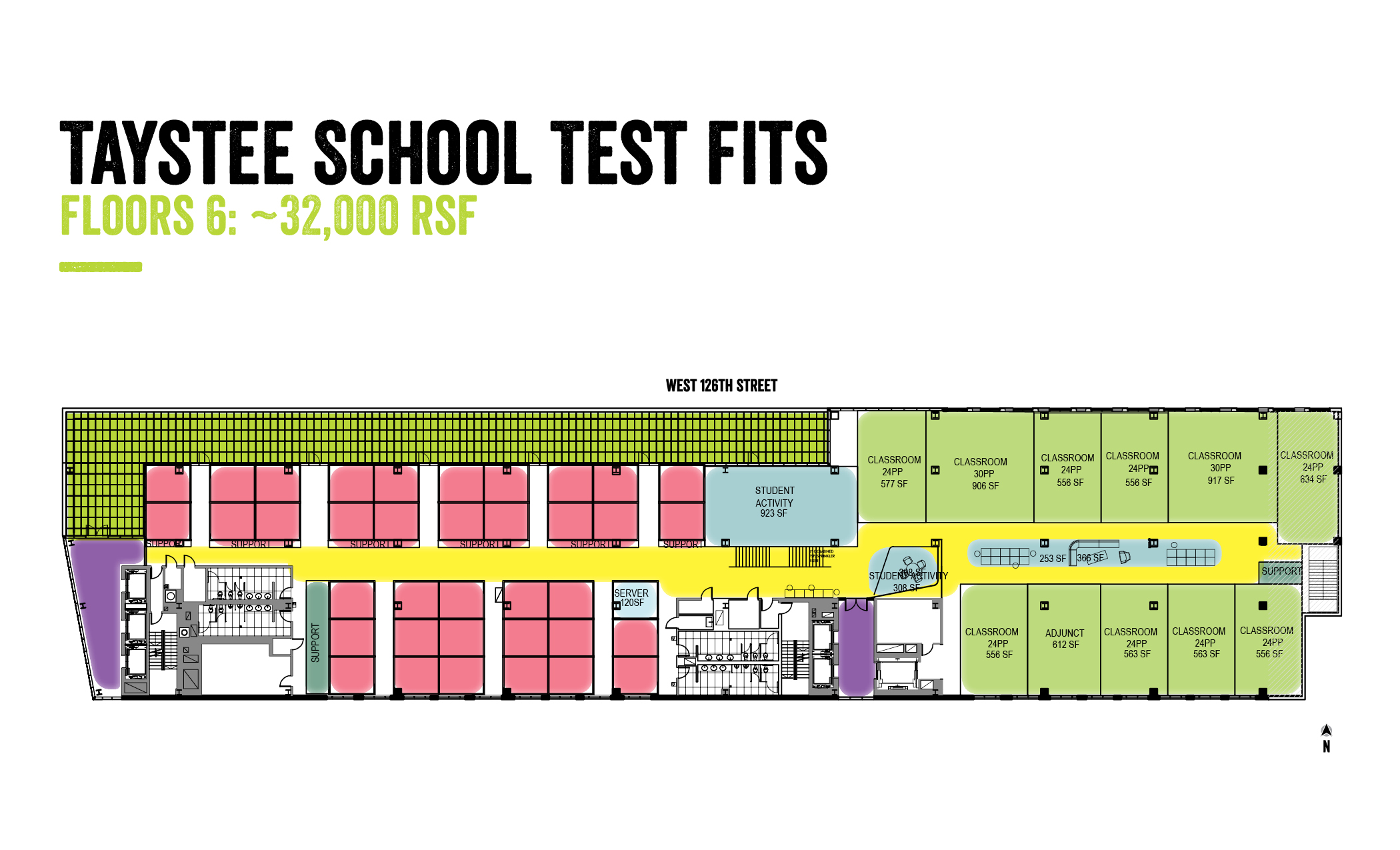

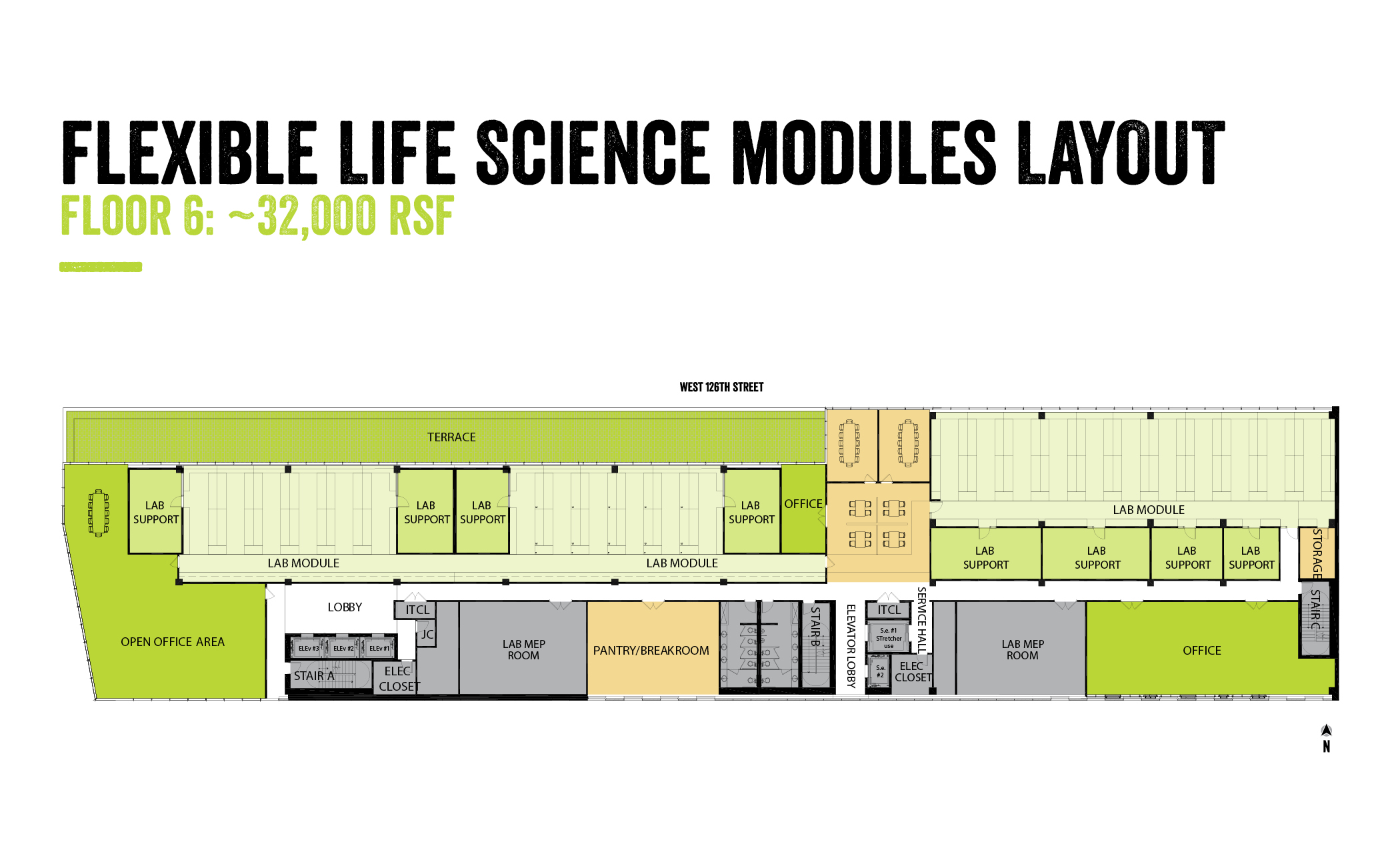

Floor 6

31,898 RSF (Terrace 3,147 SF)

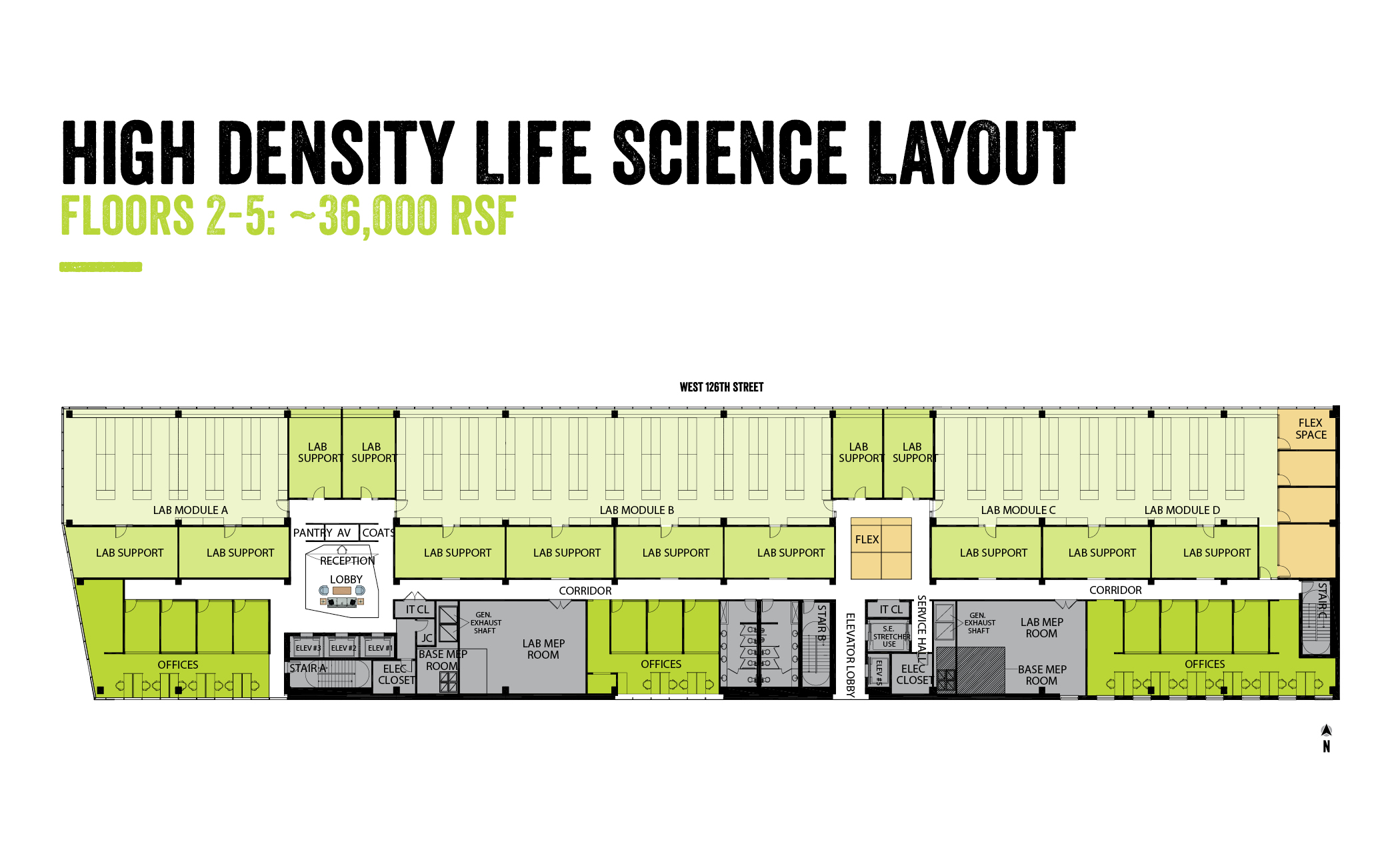

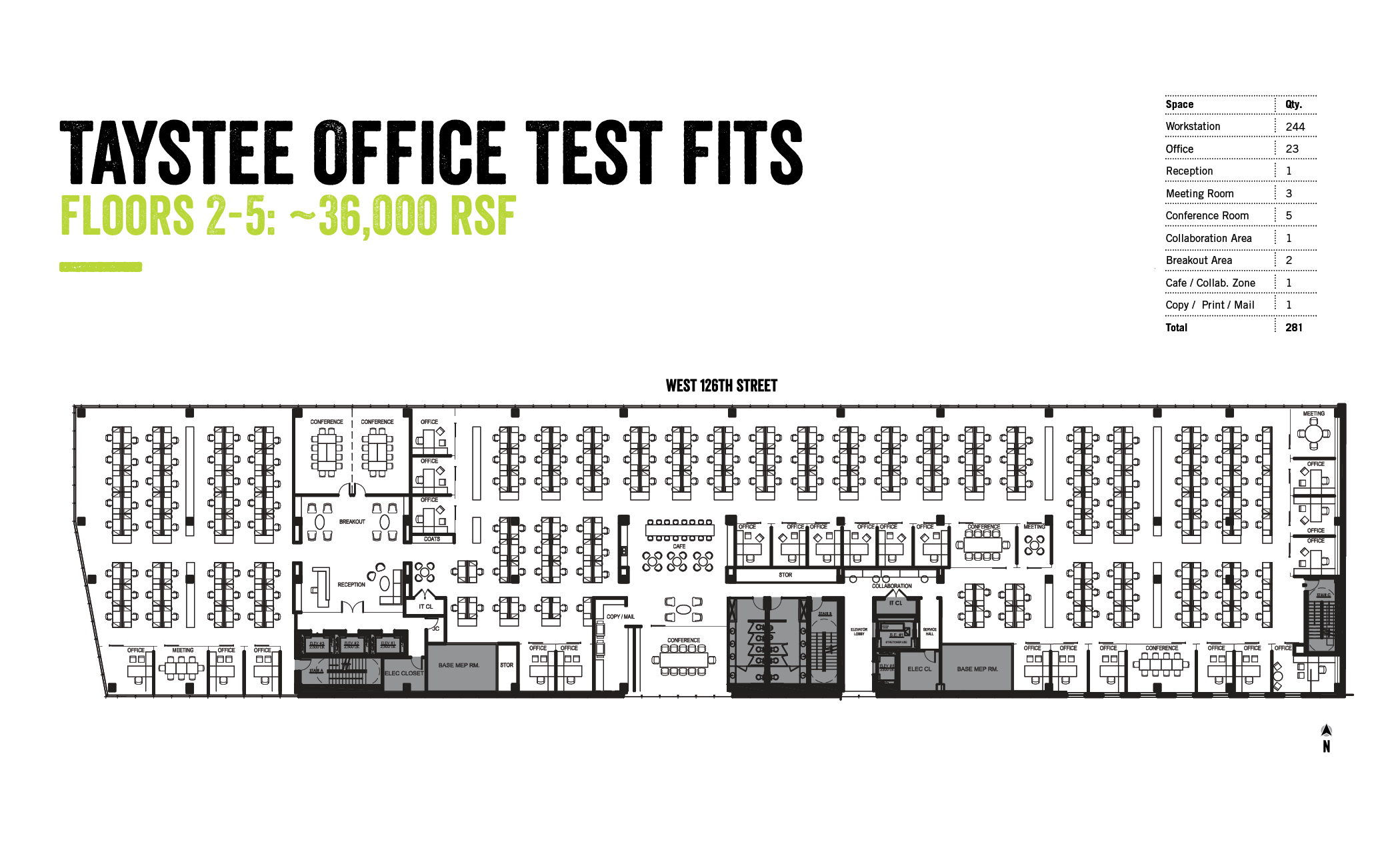

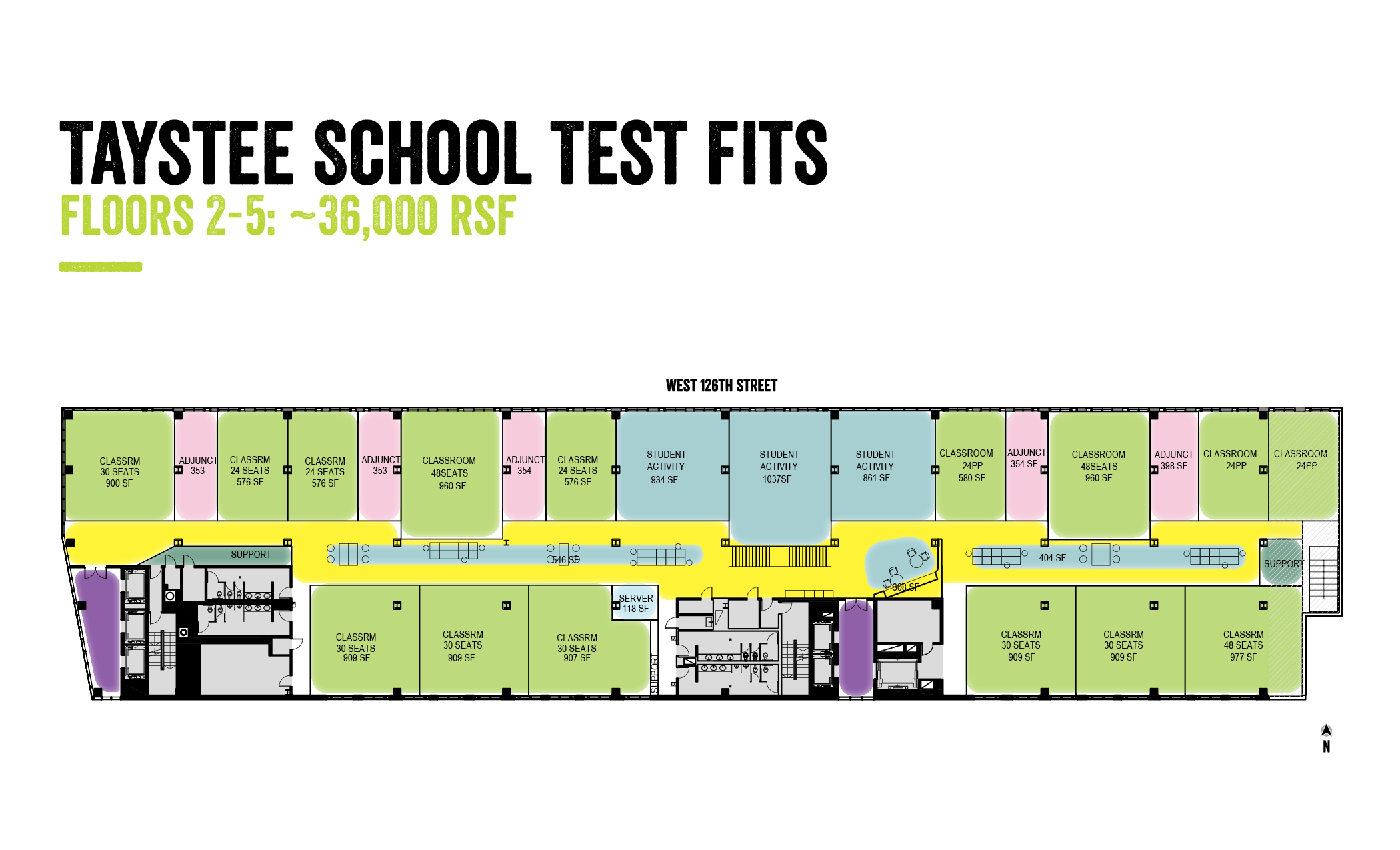

Floor 5

36,196 RSF

Floor 4

36,196 RSF

Floor 3

36,196 RSF

Floor 2

36,185 RSF (Terrace 2,265 SF)

Floor 1

19,363 RSF

Garden Level

19,806 RSF (Courtyard 3,408 SF)

Economic Incentives

RELOCATION & EMPLOYMENT ASSISTANCE PROGRAM

Taystee’s tenants that relocate jobs from outside New York City or from below 96th Street in Manhattan may be eligible to receive REAP business income tax credits equal to $3,000 per employee per year for twelve years. A company relocating 200 employees could receive a $600,000 per year income tax credit under REAP representing savings of between $15 to $20 per square foot per year.

COMMERCIAL RENT TAX EXEMPTION

Taystee’s tenants may be exempt from the occupancy tax that companies pay south of 96th Street. Users would be exampt from an annual tax of 3.9% of the rent, representing savings of more than $2 prsfpsf per year.

ENERGY COST SAVINGS PROGRAM AND BUSINESS INCENTIVE RATE

Qualifying Taystee tenants maycould benefit from reduced electricityelectricrity rates from two programs: ECSP and BIR. The first program could reduce an entire electric bill by approximately 15% to 20% for each of twelve years; the second program maycould reduce the entire electric bill by an additional 12% to 15% for fifteen years. Combined savings may range from approximately 27% to 35% of total electricity costs. Tech, life science and other manufacturers may also benefit from savings on gas charges

REAL ESTATE TAX EXEMPTION

The Taystee Lab Building has qualified will qualify for an enhanced 25 year Industrial and Commercial Abatement Program (ICAP) real estate tax benefit that will significantly reduce tenants’ occupant costs relative to competitors exposure to real estate tax increases.